An out-of-network provider is a healthcare professional or facility that does not have a contractual agreement with certain health insurance plans. While this status allows providers more freedom to set their own fees, it also presents challenges in medical billing, such as higher out-of-pocket costs for patients, balance billing issues, and possible delays in reimbursement.

To successfully manage out-of-network billing, healthcare professionals need to engage in strategic planning, maintain transparent communication with patients, and have a thorough understanding of payer policies. This approach helps ensure both financial stability for the practice and a positive experience for patients.

How Out-of-Network Providers Work in Medical Billing

- Higher Costs: Patients often incur higher deductibles, copays, and coinsurance when receiving care from out-of-network providers, requiring them to cover a larger portion of the bill out-of-pocket.

- Balance Billing: Out-of-network providers may bill patients for the difference between their charges and the amount covered by insurance, a practice known as balance billing, which can result in unexpected expenses.

- Limited Coverage: Some insurance plans provide minimal or no coverage for out-of-network services. Patients should carefully review their policies to understand their financial responsibility.

- Preauthorization Requirements: Certain insurance plans mandate preauthorization for treatments from out-of-network providers. Patients should confirm with their insurer beforehand to prevent claim denials.

The Impact on Providers

Out-of-network status also affects healthcare providers:

- Payment Rates: Out-of-network providers establish their own service fees, as they are not restricted by insurance-negotiated rates. This often results in higher charges compared to in-network care.

- Patient Collections: Collecting payments can be challenging, as patients may be unprepared for high medical bills, leading to delays or difficulties in reimbursement.

- Insurance Claims Process: Out-of-network billing tends to be more complex, requiring providers to submit claims directly to patients rather than utilizing the streamlined processes available for in-network services.

- Marketing Strategies: Providers may need to adapt their marketing efforts based on their network status, as being out-of-network can influence patient volume and overall revenue generation.

The Impact on Patients

- Financial Strain: Patients often bear a greater financial responsibility when using out-of-network services, leading to unexpected medical expenses and higher out-of-pocket costs.

- Specialist Access: Some patients may require care from specialists outside their network due to specific medical conditions. While this ensures quality treatment, it also comes with higher costs.

- Limited Provider Choices: Insurance restrictions may limit patients to in-network providers, making it difficult for those who prefer or have established relationships with out-of-network doctors.

- Reimbursement Challenges: Patients may face complex reimbursement processes, often needing to file claims themselves and submit additional documentation to their insurance company.

Difference Between In-Network Provider and Out-of-Network Provider

Definition

- In-Network Provider: A healthcare provider who has a contract with a specific health insurance plan.

- Out-of-Network Provider: A healthcare provider without a contract with the patient’s health insurance plan.

Payment Rates

- In-Network: Accepts negotiated rates set by the insurance company, leading to lower costs.

- Out-of-Network: Sets their own fees, often higher than in-network rates.

Patient Costs

- In-Network: Patients pay lower copays, deductibles, and coinsurance.

- Out-of-Network: Patients face higher out-of-pocket costs, including increased deductibles and copays.

Insurance Coverage

- In-Network: Insurance covers a larger portion of the costs, making care more affordable.

- Out-of-Network: Coverage may be limited or nonexistent, increasing expenses for patients.

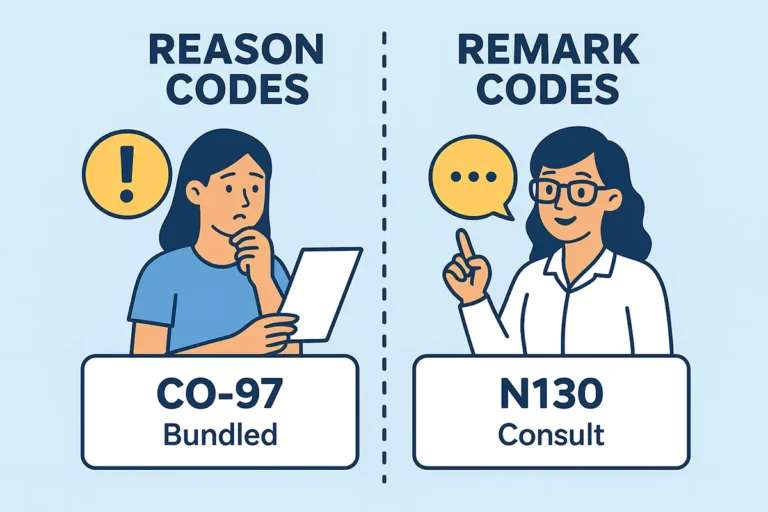

Claims Process

- In-Network: The insurance company handles claims directly, ensuring faster processing.

- Out-of-Network: Patients often need to file claims themselves and provide extra documentation for reimbursement.

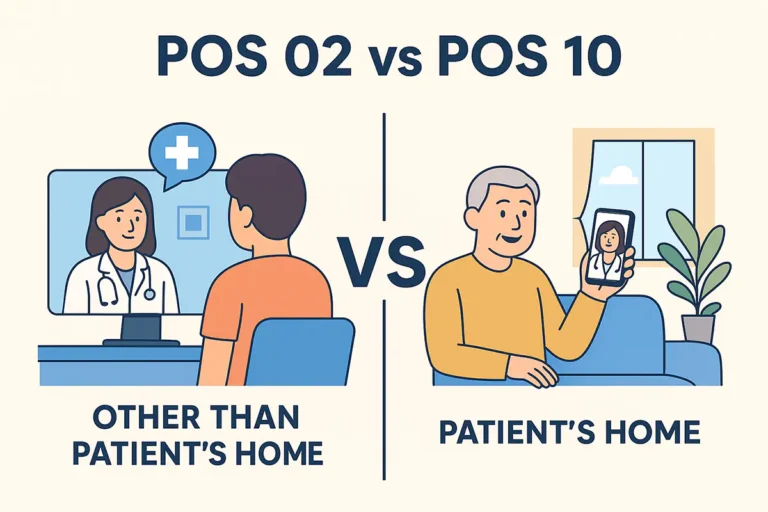

Access to Care

- In-Network: Patients have broader access to specialists and facilities within the network.

- Out-of-Network: Limited provider options may require patients to seek specialists outside the network, making coordination more difficult.