Introduction

In medical billing, even a small claim rejection can create a ripple effect — delaying payments, increasing administrative work, and weakening cash flow. Every rejected claim represents time, effort, and potential revenue lost. Understanding the most common rejection causes — and how to prevent them — is essential for maintaining a strong and compliant revenue cycle.

What Is a Claim Rejection?

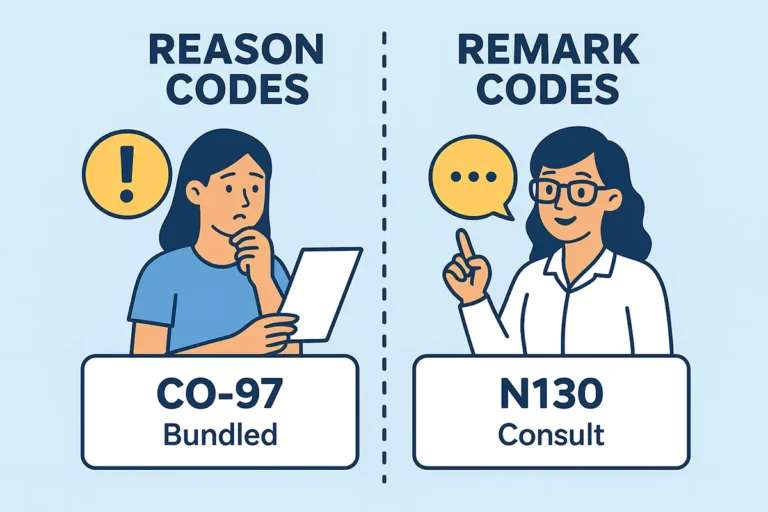

A claim rejection occurs when a payer refuses to accept a claim for processing because it contains errors, missing data, or violates payer-specific submission rules. Unlike denials, rejected claims never enter the payer’s adjudication system, meaning no payment review occurs until corrections are made and the claim is resubmitted.

Common Reasons for Claim Rejection

1. Incorrect or Incomplete Patient Information

Minor mistakes — like a wrong birth date, name spelling error, or incorrect insurance ID — are among the top causes of rejections. Patient details must exactly match what’s on file with the payer.

Example: Entering “Jonathon Smith” instead of “Jonathan Smith,” or using an outdated insurance policy number.

2. Invalid or Missing Diagnosis and Procedure Codes

Claims must have accurate and compatible ICD-10, CPT, and HCPCS codes that reflect medical necessity. Missing modifiers, invalid codes, or mismatched pairs can trigger an automatic rejection.

Example: Using a CPT code that doesn’t support the diagnosis or forgetting required modifier 25 for same-day evaluation and management.

3. Incorrect or Missing Taxonomy Code

Each provider’s taxonomy code identifies their specialty. When this doesn’t match what’s registered in payer or NPPES records, claims often reject for credentialing or validation errors.

Example: Submitting a claim under a “Behavioral Health” taxonomy when the provider is credentialed as a “Clinical Social Worker.”

4. Invalid or Missing Referring Provider NPI

For services requiring a referral or prior authorization, the referring provider’s NPI must be included. If this NPI is missing, inactive, or not on file with the payer, the claim will reject.

Example: Submitting a physical therapy claim without the referring physician’s NPI listed.

5. Lack of Prior Authorization or Referral

Certain procedures — especially imaging, therapy, and behavioral health — require prior authorization. Without it, the payer will reject the claim even if the service is valid and necessary.

6. Out-of-Network or Uncredentialed Provider

Claims billed under a provider who is not credentialed or listed as in-network for that payer will be rejected or reimbursed at out-of-network rates.

Example: Billing under an LPC (Licensed Professional Counselor) when the payer only covers LCSW (Licensed Clinical Social Worker) services.

7. Duplicate Claim Submission

Submitting the same claim more than once without proper notation causes an automatic rejection for duplication.

8. Missing Supporting Documentation

Certain claims require clinical documentation or notes to support medical necessity. Missing attachments or incomplete documentation can cause rejection or delay.

9. Incorrect Billing or Rendering Provider Details

Errors in the billing provider’s NPI, Tax ID, or address can cause claim validation errors in payer systems, leading to immediate rejection.

How Claim Rejections Cause Revenue Loss

1. Delayed Reimbursements

Each rejected claim must be reviewed, corrected, and resubmitted — often delaying payments by weeks or months.

2. Increased Administrative Costs

Billing staff spend extra hours tracking, editing, and reprocessing claims, leading to higher overhead.

3. Lost Revenue

Many rejected claims are never resubmitted or exceed payer filing limits, resulting in permanent revenue loss.

4. Cash Flow Instability

Frequent rejections interrupt consistent payment cycles, creating financial instability for practices.

5. Compliance Risks

Ongoing billing errors and poor documentation practices may raise red flags with payers and increase audit risk.

How to Prevent Claim Rejections?

- Verify patient eligibility and benefits before each visit.

- Use correct taxonomy and NPI combinations that match credentialing records.

- Include referring provider NPIs where required.

- Track prior authorization and referral requirements by payer.

- Validate claims using automated scrubbing tools before submission.

- Review and update coding regularly to follow payer-specific guidelines.

- Maintain complete, clear documentation for all billed services.

- Monitor rejection reports and analyze trends to prevent recurring issues.

How Solubillix Helps Providers Prevent Claim Rejections

At Solubillix, we specialize in helping healthcare providers eliminate costly claim rejections and maximize clean claim submissions. Our advanced Revenue Cycle Management (RCM) solutions combine automation, analytics, and expert billing oversight to ensure every claim is accurate, compliant, and payer-ready before submission.

Here’s how Solubillix supports providers:

✅ Automated Claim Scrubbing:

Our smart claim-scrubbing technology scans for missing modifiers, incorrect codes, invalid NPIs, and taxonomy mismatches before submission — preventing rejections at the source.

✅ Real-Time Eligibility Verification:

We verify patient insurance and benefits in real time, reducing rejections caused by invalid coverage or plan changes.

✅ Credentialing and Taxonomy Alignment:

Solubillix ensures each provider’s NPI and taxonomy codes match payer credentialing records, avoiding taxonomy-related denials and rejections.

✅ Referral and Authorization Tracking:

Our system monitors referral and prior authorization requirements automatically, ensuring all necessary data is included on claims.

✅ Expert Compliance Review:

Our billing experts stay current with CMS and payer policy changes, so your claims remain compliant and audit-safe.

✅ Claim Rejection Analysis:

We track rejection patterns and create prevention strategies that continuously improve your claim acceptance rate.

✅ End-to-End Follow-Up:

From initial claim submission to payment posting, our team ensures every claim reaches resolution — so no revenue is left behind.

Conclusion

Claim rejections may seem routine, but they carry a serious financial impact. By identifying the root causes — from taxonomy mismatches to referral NPI errors — and partnering with Solubillix, providers can reduce rejections, shorten payment cycles, and strengthen their overall revenue performance.

At Solubillix, we don’t just fix rejected claims — we prevent them before they happen, ensuring that your practice stays profitable, compliant, and focused on patient care.