🩺 Introduction

In healthcare, Revenue Cycle Management (RCM) isn’t just about billing — it’s the heartbeat of your financial operations. Every process, from patient registration to payment posting, affects your bottom line. Yet, many practices unknowingly lose thousands of dollars each year due to inefficiencies, errors, or outdated workflows hidden within their RCM system.

An RCM audit is like a health check for your practice’s financial system. It reviews each stage of the revenue cycle — from coding accuracy to claim submission and payment reconciliation — to uncover revenue leakage, compliance risks, and operational bottlenecks.

At Solubillix, we specialize in performing in-depth RCM audits that go beyond surface-level issues. Our goal is to help practices strengthen compliance, reduce denials, and improve revenue recovery.

If your practice shows any of these warning signs, it’s time to consider a professional RCM audit.

1️⃣ Increasing Claim Denials and Rejections

Consistent claim denials are one of the first indicators that your RCM process isn’t running as efficiently as it should. A denial rate higher than 5% can significantly reduce your revenue potential and delay reimbursements.

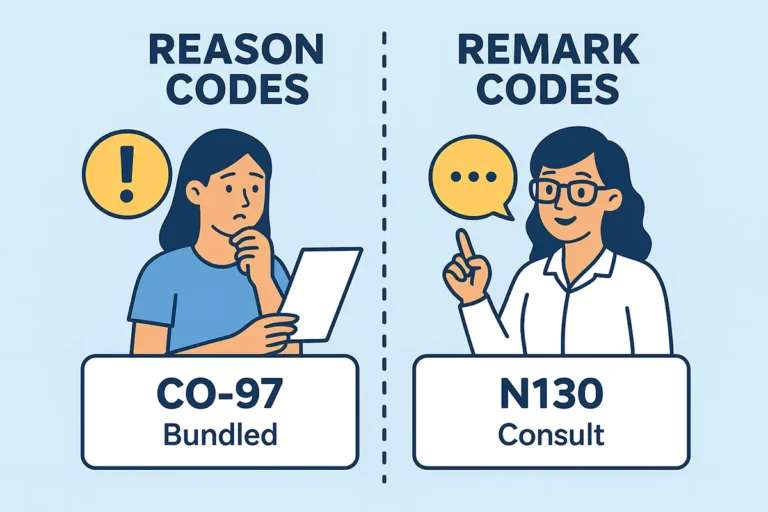

Some of the most common causes of denials include:

- Missing or incorrect CPT–ICD-10 linkage

- Lack of insurance verification or expired coverage

- Missing modifiers (e.g., Modifier 25, 59)

- Duplicate claim submission

- Documentation not supporting medical necessity

A professional RCM audit evaluates both front-end and back-end processes — from charge capture and eligibility checks to coding and claim submission accuracy.

At Solubillix, our audit team analyzes historical claim data to detect recurring patterns and implement process-level corrections that prevent future denials before they occur.

2️⃣ Delayed Payment Posting and Growing Accounts Receivable (AR)

If your AR aging report shows a growing balance in the 60–90 day range, your practice is likely losing track of payments or not following up promptly. Payment posting delays or incomplete reconciliation can distort your financial picture and disrupt cash flow.

An RCM audit looks for:

- Payment posting backlogs or incorrect allocations

- Missing secondary or tertiary claims

- Lack of follow-up on payer responses

- Delayed denial reprocessing

- Inconsistent communication between billing and front-desk staff

At Solubillix, we monitor Days in AR, Claim Turnaround Time, and First-Pass Acceptance Rate to ensure your revenue moves quickly and cleanly through the billing pipeline.

Our RCM audits help identify root causes, such as workflow inefficiencies or lack of follow-up automation, so your team can focus on collections instead of corrections.

3️⃣ Coding Errors and Documentation Gaps

Accurate coding is at the core of compliance and reimbursement. However, even experienced coders can make mistakes, especially when guidelines or payer rules change. Coding errors can lead to underpayments, overpayments, or even compliance penalties.

An RCM audit reviews:

- CPT and ICD-10 accuracy across all encounters

- Proper modifier usage (e.g., 25, 59, 91, 95)

- E/M coding levels and supporting documentation

- Frequency of downcoding or upcoding

- Internal consistency between provider notes and billed services

At Solubillix, we ensure every CPT and ICD code is validated against current CMS and payer guidelines. We also provide training recommendations to keep providers compliant and informed.

A clean coding structure not only improves reimbursements but also safeguards your practice from payer audits and compliance risks.

4️⃣ Limited Financial Visibility and Reporting Gaps

If your practice cannot easily access metrics such as denial rate, AR by payer, or collection ratio, you may have limited visibility into your financial performance. This often happens when reports are not standardized or data is scattered across different systems.

An RCM audit helps uncover:

- Inconsistent or outdated reporting formats

- Lack of real-time dashboards for revenue tracking

- No clear ownership of key financial indicators

- Overreliance on manual spreadsheets rather than automated systems

At Solubillix, we believe transparency drives accountability. Our audits review your financial reports and create customized KPI dashboards to help you track every stage of your RCM performance.

With better visibility, decision-makers can take proactive action — whether it’s addressing claim rejections, optimizing coding, or identifying high-performing payers.

5️⃣ Frequent Payer Recoupments, Take-Backs, or Compliance Alerts

Frequent payer recoupments or post-payment audits are serious red flags. They often signal inconsistencies between billed services and clinical documentation.

Common triggers include:

- Inaccurate CPT or HCPCS usage

- Missing medical necessity documentation

- Overlapping claims for the same service date

- Billing for non-covered or experimental procedures

- Lack of compliance with payer-specific billing guidelines

An RCM audit by Solubillix ensures that every billed service aligns with clinical documentation and payer rules. We also assess your internal compliance policies to help prevent future recoupments or audit triggers.

Our team maintains strict adherence to HIPAA, OIG, and CMS regulations, ensuring every audit enhances both compliance and financial integrity.

💼 The Value of a Professional RCM Audit

A professional RCM audit provides clarity, compliance assurance, and actionable insight. Beyond correcting current issues, it helps you build a sustainable, scalable billing process that prevents future losses.

Key Benefits of an RCM Audit with Solubillix:

✅ Identify revenue leakage and compliance risks

✅ Optimize claim submission and follow-up workflows

✅ Improve clean claim rates and reduce AR days

✅ Strengthen documentation and coding compliance

✅ Gain real-time visibility with custom reports and KPIs

🧭 Final Thoughts

Your RCM process is only as strong as its weakest link. Minor inefficiencies, if ignored, can grow into serious financial drains over time. A professional RCM audit doesn’t just highlight issues — it provides a roadmap for long-term improvement, compliance, and stability.

At Solubillix, our team of certified billing and RCM specialists works closely with healthcare providers to build efficient, compliant, and transparent billing systems. Whether you’re a small practice or a large group, we help you protect your revenue — one clean claim at a time.

Solubillix: Precision. Compliance. Profitability.